SPRINGFIELD, Ill. (WAND) — Illinois Treasurer Michael Frerichs is spearheading an effort to help families put leftover college savings funds into retirement plans. The change could happen quickly in Illinois thanks to action by the federal government.

Frerichs told reporters in Chicago Tuesday that he is looking out for families who don't use all of the money in their college savings accounts to roll over funds into a Roth IRA. The Democrat said Congress approved a bill in late 2022 to allow tax and penalty free rollovers from college savings plans to retirement plans.

"People are going to be saving their own money into these accounts," Frerichs said. "But if we don't make it easier for people to save, if we don't give them more incentives to save and they're unable to retire, for young people entering the workforce, those are positions that won't be available."

Related Links

- Treasurer Frerichs encourages Illinois families to save for college

- State treasurer issues reminder to new parents on free college savings deposit

Illinois would need a change in state law to allow people to take advantage of this opportunity. Sen. Steve Stadelman (D-Rockford) and Rep. Diane Blair-Sherlock (D-Villa Park) said it is a common sense change that could help parents, grandparents and guardians who open savings accounts for their young families.

"A lot of parents are in that position where they want to save and they want to do the right thing early on," Blair-Sherlock said. "But then as they learn that their children may not be able to go to college and they're stuck in this plan, what do they do? Well, now we have a good option for these parents."

Could college savings rollovers help elder Illinoisans?

The legislation has gained strong bipartisan support and recently passed out of Senate and House committees unanimously. This comes as 71% of AARP members in Illinois say they are very anxious about having enough money to live comfortably during retirement.

AARP Illinois President Al Hollenbeck said 93% of members consider having enough money and savings to retire to be their top economic concern.

"The importance of saving early and starting to build a nest egg for the future cannot be understated," Hollenbeck said.

The 2022 federal law states rollovers must by made by the 529 college savings account beneficiary and not the owner. Congress also noted that rollovers can only be made from 529 accounts that have been active for 15 years.

Senate Bill 3133 currently awaits third reading in the Senate. Meanwhile, House Bill 5005 could be heard on second reading when the House returns for session next week.

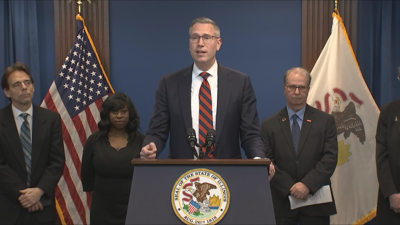

Treasurer Michael Frerichs (D-Illinois) speaks during a press conference in Chicago on March 26, 2024.

"It encourages more people to save for their kids' future and allows planning for retirement as well," Frerichs added. "Unfortunately, state law only allows tax deductions on contributions to 529 for certain approved expenses."

Frerichs, Blair-Sherlock and Stadelman are optimistic that Gov. JB Pritzker will sign the proposal if it passes out of both chambers.

Copyright 2024. WAND TV. All rights reserved.