DECATUR, Ill. (WAND) – When you use insurance to pay for a drug prescription there is a good chance you use a copay to pay part of the cost. But what you may not know there is often an unseen middleman increasing costs for you and your pharmacist.

The middleman is known as a Pharmacy Benefit Manager, or PBM. PBM’s negotiate drug prices between drug makers, insurance providers and pharmacies. The PBM impacts you and your neighborhood pharmacist in a couple of ways through two types of transactions known as clawbacks. Copay clawbacks and DIR fees. Let’s look at copay clawbacks first:

"When you go into the pharmacy you’re paying a higher price than what that pharmacy is being reimbursed,” stated fraud investigator Susan Hayes of Pharmacy Outcomes Specialists in Lake Zurich, Illinois. “So it’s very much hurting consumers.”

It works like this. When you purchase certain drugs you are often charged a copay. If the cost of the drug and pharmacy fee is less than the copay the PBM takes, or claws back, the difference.

We found an actual example of this practice in a class action lawsuit when a patient received a prescription for an antidepressant known as sertraline.

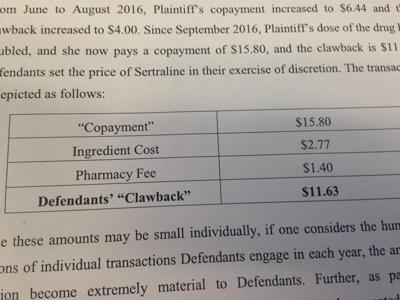

The patient was required to make a copay of $15.80.

The cost of the ingredient was $2.77, along with a pharmacy fee of $1.40, for a total cost of $4.17.

Instead of returning the remaining $11.63 to the patient the PBM pocketed, clawed back, that amount. Even though the patient had insurance they paid the full amount of the transaction.

The $11.83 is a small amount of money, but transactions like these happen each day allowing the PBM’s to pocket millions of dollars each year.

"The problem with the clawback is with a lot of the very large front end deductibles the patient is paying one hundred percent of the claim,” Hayes noted.

One of the nations largest PBM’s, Express Scripts, posted on its website in January 2017, it does not engage in copay clawbacks calling the clawbacks an “anti-patient practice”.

Your prescription, in some cases, may actually be cheaper if you pay cash as opposed to using your insurance. A fact your pharmacist may not be able to tell you unless you ask. PBM’s often impose gag rules prohibiting pharmacists from telling you cash may be cheaper unless you ask.

"If a pharmacist says, hey if I adjudicate this claim it’s $50. If you pay me cash it’s $15. That pharmacist can potentially lose it’s contract with the pharmacy benefit manager,” Hayes said.

The second type of clawback is called a DIR fee. These fees are charged to your neighborhood pharmacies.

“It truly is just a way that they can lower the amount that they are paying individual pharmacies,” Dale Colee of Dale’s Southlake Pharmacy told WAND News.

PBM’s claim they charge DIR fees to guarantee pharmacies meet certain standards such as making sure they sell a certain amount of generic drugs to hold down patient costs.

Colee operates pharmacies in Decatur and Forsyth and says DIR fees can be clawed back from his businesses months after filling a prescription.

"Ninety days after the transaction is complete they can come in and take up to $15 to $18 back from me,” Colee stated.

The fees taken from a pharmacist can be substantial. The I-TEAM found an actual example where one pharmacy is being charged by a PBM as much as $552 to more than $1,000 every week. Pharmacists can lose money on transactions where DIR fees are clawed back.

“You think on the initial transaction you maybe have $5, or $10, or $12 on this thing,” Colee said. “And then 90 days later they’ll come in and clawback, or take back, $15.”

Susan Hayes says she is not an expert in ethics. However, she does have a personal opinion when it comes to clawbacks and their impact on people.

“In today’s environment where drug costs are going up astronomically asking an individual patient to pay 15 percent to 20 percent more is just not ethical in my book,” Hayes stated.

Bloomberg reported in February 2017 since last fall at least 16 lawsuits have been filed against PBM’s in relation to drug prescription clawbacks.