CHAMPAIGN, Ill. (WAND) — Help is returning to those who need assistance with income tax filing.

The University of Illinois’ Volunteer Income Tax Assistance (VITA) program is back to offer free tax assistance to low-income (gross income less than $67,000), elderly, disabled, and limited English speaking taxpayers.

Those interested should bring ID and tax documents to Salt & Light (1819 Philo Road, Urbana) during VITA drop-off hours. No appointment is necessary.

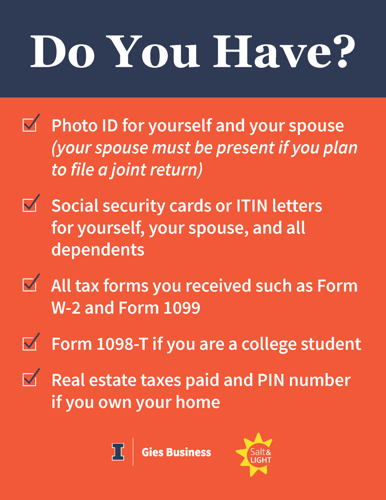

What to bring:

Photo ID for yourself and your spouse. (Your spouse must be present if you plan to file a joint return.

Social security cards or ITIN letters for yourself, your spouse, and all dependents (for example, your children).

All tax forms you received such as Form W-2 and Form 1099.

Form 1098-T (if you are a college student).

Real estate taxes paid and PIN if you own your home.

Bank routing and account number (if you'd like direct deposit of your refund).

During the visit, a trained volunteer will have a quick conversation, verify identification, and scan relevant documents. After the visit, students from the Department of Accountancy at Gies College of Business, trained through the IRS VITA program, will prepare the return.

VITA Drop-off Hours (Salt & Light, 1819 Philo Road, Urbana)

Tuesday: 3-7 pm

Wednesday-Friday: 1-5 pm

Saturday: 11 am-5 pm

No drop-offs on Sunday or Monday

Graduate accounting students, who are especially interested in tax, will be preparing the tax returns. Instructor of Accountancy Mandi Alt, who brings more than 20 years of tax experience, will once again guide the program alongside seven other Gies faculty members.

Millikin University is also participating in the VITA program. Appointments will be held at the Decatur Public Library and tax services will be offered to:

People who generally make $67,000 or less

Individuals who are 60 years of age and older

Call 217-424-6203 to schedule an appointment with Millikin's VITA program.

Copyright 2025. WAND TV. All rights reserved.