SPRINGFIELD, Ill. (WAND) — Gov. JB Pritzker signed a proposal into law Friday to help families put leftover college savings funds into retirement plans.

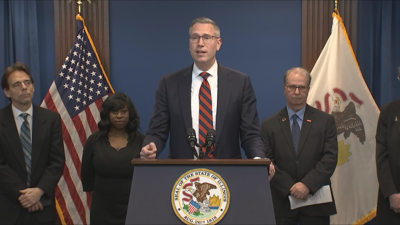

Treasurer Michael Frerichs (D-Illinois) speaks during a press conference in Chicago on March 26, 2024.

Treasurer Michael Frerichs and state lawmakers told reporters in March that families who don't use all of the money in their college savings accounts could put them into a Roth IRA. Frerichs noted that Congress approved a bill in late 2022 to allow tax and penalty free rollovers from college savings plans to retirement plans.

"People are going to be saving their own money into these accounts," Frerichs said. "But if we don't make it easier for people to save, if we don't give them more incentives to save and they're unable to retire, for young people entering the workforce, those are positions that won't be available."

Sen. Steve Stadelman (D-Rockford) and Rep. Diane Blair-Sherlock (D-Villa Park) said this is a common sense change that can help parents, grandparents and guardians who open savings accounts for their young families.

"Parents can have increased comfort with their 529 plans by alleviating concerns about unintended taxation and allowing families to maximize the time value of their money," Stadelman said.

The 2022 federal law states rollovers must be made by the 529 college savings account beneficiary and not the owner. Congress also noted that rollovers can only be made from 529 accounts that have been active for 15 years.

Senate Bill 3133 took effect immediately.

Copyright 2024. WAND TV. All rights reserved.